Geneva,, Switzerland, December 4th, 2025, FinanceWire

The trading platform Market10.net today announced a suite of enhanced tools and features designed to support traders engaging in cryptocurrency contract‑for‑difference (CFD) trading.

By broadening its support across multiple asset classes and integrating real‑time data, advanced charting, and risk‑management capabilities, Market10.net aims to deliver an enriched trading environment suited to both experienced and emerging market participants.

Expanded asset variety including cryptocurrencies

Market10.net highlights its ability to offer CFD access not only across traditional markets such as forex, metals, indices, and shares, but also a dedicated cryptocurrency segment. Users can engage with CFDs on major digital assets such as Bitcoin (BTC) and Ethereum (ETH) within the same trading environment already used for other instruments.

This expanded asset variety means traders can view crypto instruments alongside other CFDs, enabling more holistic portfolio monitoring and strategy implementation.

Real‑time market data and industry‑grade charting

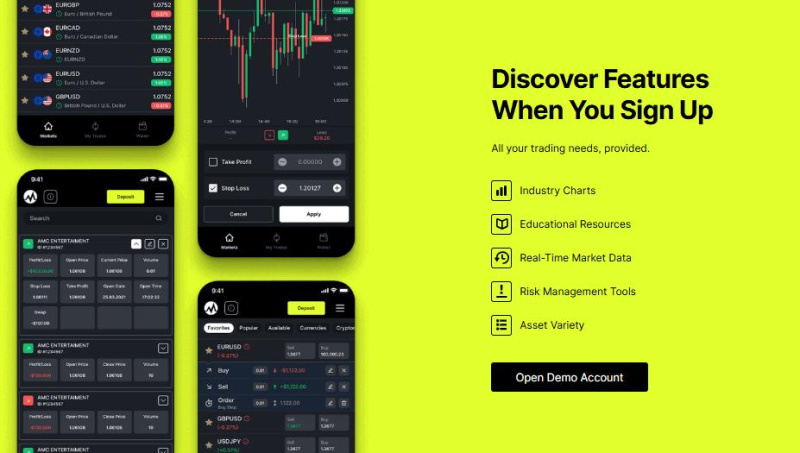

A key feature of Market10.net’s latest update is the inclusion of real‑time market data streams and advanced charting tools under the “Industry Charts / Real‑Time Market Data” heading.

This equips users with the capability to monitor price movements, volatility shifts, and emerging trends in cryptocurrency markets as they happen — an important factor in CFD trading where timing and execution can be critical.

The charting infrastructure is described as industry‑grade, supporting the multi‑asset execution model of the platform.

Educational resources and support for strategy development

To address the complexity of trading CFDs in volatile markets such as cryptocurrencies, Market10.net emphasizes its “Educational Resources” suite aimed at both nascent and experienced traders.

The educational materials are positioned as a way to help users understand the mechanics of CFD trading, including leverage, margin, asset classes, and underlying market behavior. For those engaging with crypto CFDs — which may be unfamiliar to some traders — this resource may assist in building more informed trading strategies and risk frameworks.

Risk‑management tools and increased transparency

In recognition of the heightened risks inherent to leveraged CFD trading, especially in crypto markets, Market10.net draws attention to its “Risk Management Tools” offering.

These tools include features designed to help users monitor margin levels, understand leverage implications, and manage exposure across their portfolios. The platform also provides open risk warnings — for example, noting that CFDs are complex products, traders do not own underlying assets, and leverage can work against them.

This emphasis on transparency aligns with current regulatory expectations for derivative trading platforms.

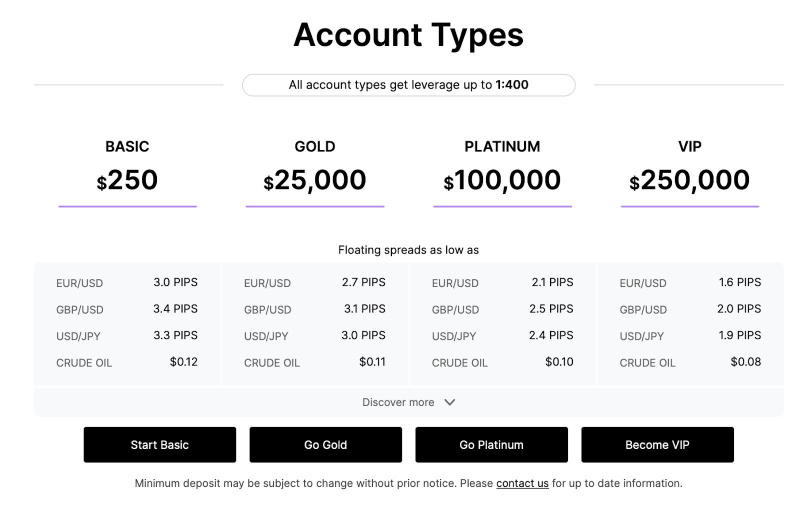

Account types and demo access for hands‑on experience

To accommodate varying levels of trading experience and risk appetite, Market10.net offers different account types, including a demo account option. Prospective users can open a demo account and access the full feature set before moving to a live trading environment.

The availability of a simulation environment is particularly relevant in the context of crypto CFD trading, where market dynamics such as high volatility or extended trading hours may present unfamiliar conditions.

Global reach with regulatory context

Market10.net is operated by Faraz Financial Services (PTY) Limited, a South‑African investment firm authorised and regulated by the Financial Sector Conduct Authority (FSCA).

The platform emphasizes that it does not provide services within certain jurisdictions — such as the European Economic Area, the USA, and Canada — and that its services are not intended as financial advice. Such disclosures reflect an awareness of regulatory complexity in global derivative and crypto markets.

Use case: bridging asset classes for diversified strategy

By integrating crypto CFDs alongside traditional instruments, Market10.net allows traders to build multi‑asset strategies from a single interface. For example, a trader might balance exposure to forex and commodity CFDs with selected crypto CFD positions while applying the same risk‑management rules and trading tools.

The real‑time data and charting functions enable continuous monitoring of correlations and divergences across asset types — a potentially useful feature amid the increasing interplay between crypto markets and broader financial markets.

Looking ahead

The launch of these tools comes at a time when interest in cryptocurrency derivatives and CFD trading continues to grow globally. While crypto assets remain volatile and speculative, platforms offering professional‑grade infrastructure — including risk controls, real‑time data, and regulatory transparency — may provide more structured environments for active traders.

Market10.net’s enhancements can be seen as part of this broader industry trend.

About Market10.net

Market10.net is the trading brand operated by Faraz Financial Services (PTY) Limited, a South‑African regulated investment firm headquartered in Johannesburg.

The platform offers access to a wide array of CFD instruments including forex, commodities, indices, shares, and cryptocurrencies. Designed to support traders at various experience levels, it combines real‑time market access, industry‑grade charting, educational resources, and risk‑management tools under one interface.

Market10.net is not a financial adviser; trading CFDs involves significant risk, and users are encouraged to consider their objectives and risk tolerance before engaging.